Malaysia Car Import Tax

This sales tax exemption on purchases of new vehicles was previously granted from 15 th June 2020 until 31 st December 2020 and was further extended by another 6 months to 30 June 2021 by the MoF as an incentive to spur car sales at a time when the industry is. After 3 years Your import car tax will be reduced by 30 1st year 15 2nd year 15 3rd year total 60 tax.

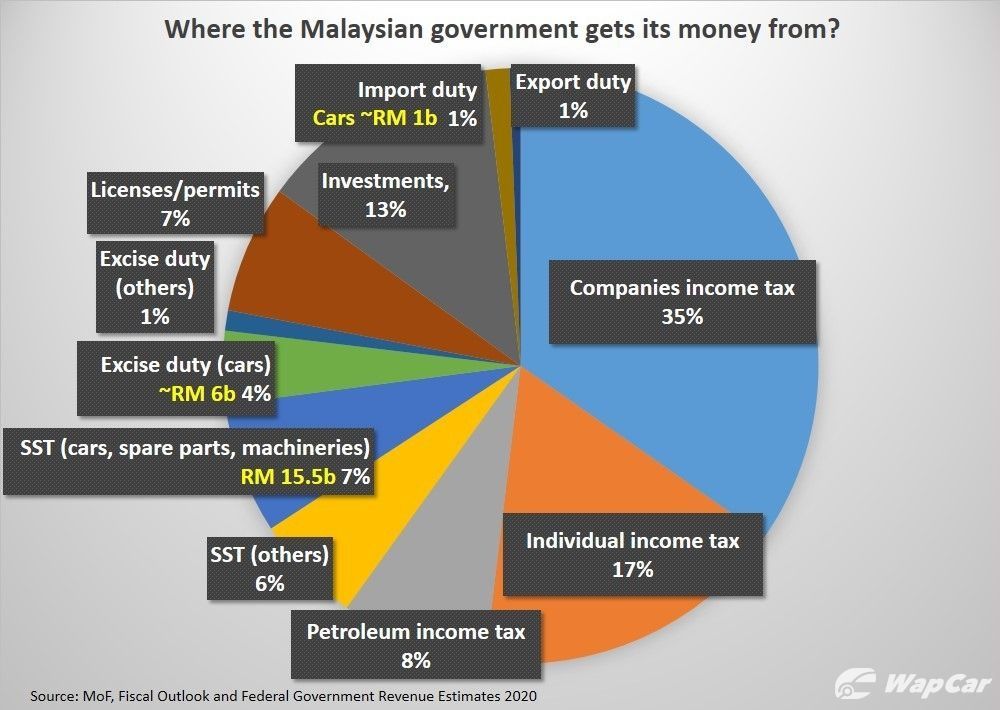

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Register an account.

. Import Calculator Tutorial Video JPY. For example if the declared value of your items is 500 MYR in order for the recipient to receive a package an additional amount of 5000 MYR in taxes will be required to be paid to the destination countries government. Step 2 6.

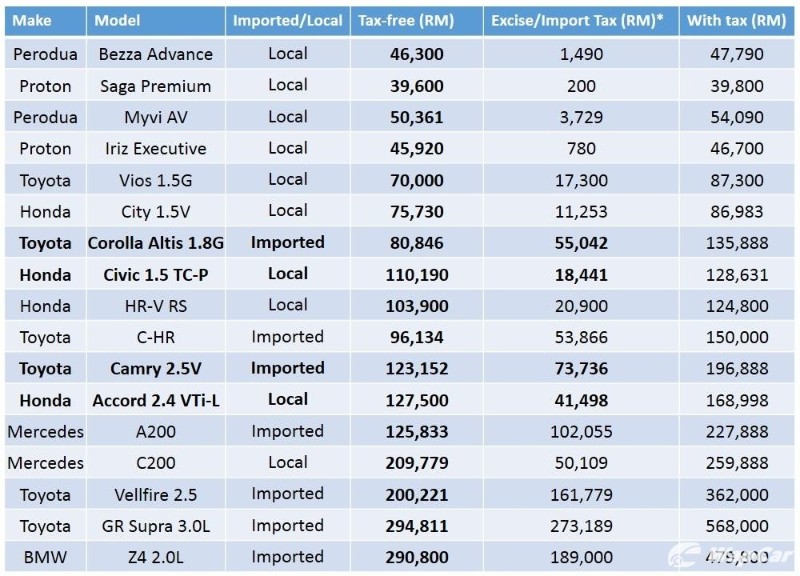

Direct import concept solution D concept car import tax malaysia car import agent Malaysia car import rules and regulations car import duty import car from australia to Malaysia malaysia car import tax calculator how to import a car shipping car to malaysia recond car AP car car. Import duty must be paid on any vehicles imported into Malaysia. Import Duties For Passenger Cars Petrol Engine.

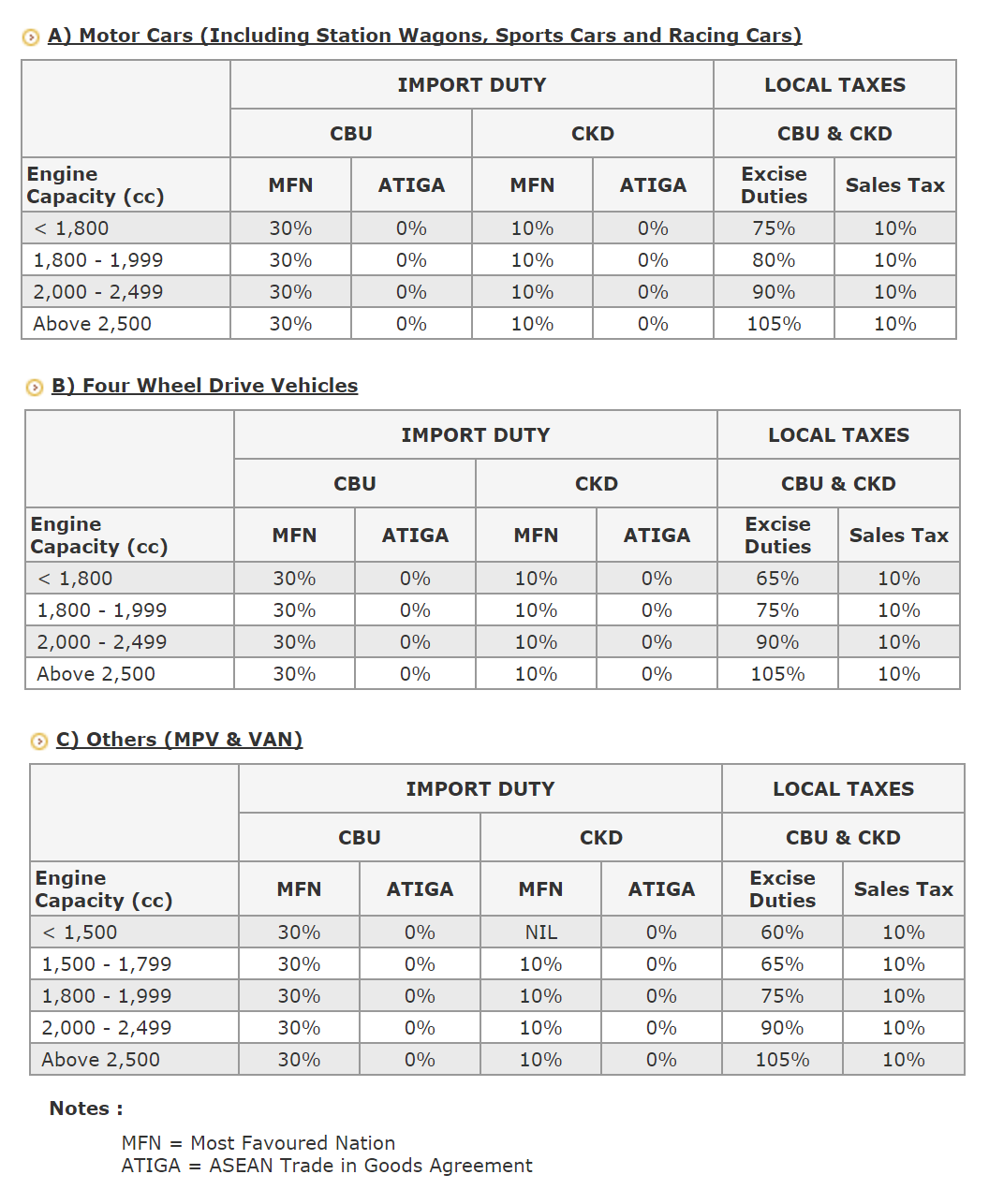

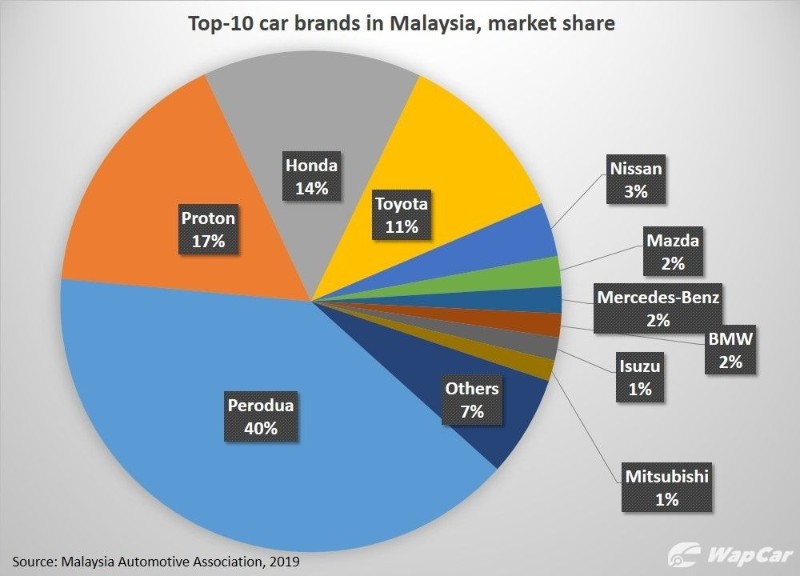

The price of a car is determined by its manufacturer taking into consideration various factors and market forces. Cost of maintenance and parts for foreign cars are also factors to be considered. Car prices are further escalated by the tax rate.

50 sales tax exemption for the purchase of imported cars also referred to as completely built-up CBU cars Currently the sales tax for vehicles is set at 10 for both locally assembled and imported cars. But the excise duty will be raised to 60 percent from 55 percent meaning an effective tax rate cut of 12 percent. For details about import duties and local taxes from the.

Conditions that need to be fulfilled to qualify for an Import License for a private motor vehicle. In Malaysia no import duty is imposed for cars originating from Asean countries while 30 import duty is imposed on vehicles imported from non-Asean countries. A person who has been in the country on this programme for at least two years may sell the imported car.

Buy this car brand new pay about RM150000 deposit cash and the rest will be a new car loan that will be arranged by the dealer. 1799cc or under Vehicle Engine Cylinder Capacity. Join as Partner Agent.

So why are cars expensive in Malaysia. Import duties run to as high as 300. Sales Tax 1500 30 0 NIL 0 60 10 1500 - 1799 30 0 NIL 0 65 10 1800 - 1999 30 0 10 0 75 10 2000 2499 30 0 10 0 90 10 Above 2500 30 0 10 0 105 10 Class MFN ATIGA MFN ATIGA Excise Duties Sales Tax All 30 0 NIL 0 NIL 10 Notes.

Needless to say if your car is rare or indeed not available in Malaysia these factors become paramount. 1800 cc to 1999. Import duties are generally levied on an ad valorem basis but may also be imposed on a specific basis.

Import Regulations. With the exemption in place it means that the sales tax is fully waived for locally assembled car or charged at 5 for imported cars. The car must be for personal use only and under this scheme the owner is exempt from paying import duty excise duty and sales tax on the car.

Welcome back username Log Out. Duties Taxes Calculator to Malaysia. RM Exchange rates are updated every Sunday following CIMB rates Full Breakdown.

Import regulations duties ports for Japanese used cars in Malaysia. After 1 year Your import car tax will be reduced by 30. In Malaysia sales tax for vehicles has been set at 10 for both locally assembled and imported cars.

Car age limit Inspection required documents etc. Now the import tax on a brand new car like this will be about RM12 million or so. Residing overseas legally for a period of not less than one 1 year.

Dont have an account. The same CKD car imported from non-ASEAN countries will now be subjected to an. Estimated tax free price at launch in November 2019 was RM908000 before any import taxes and options were included.

Vehicle must be registered under the applicants name for a period of not less than nine 9 months from the date of vehicle registration to the date of return to Malaysia. 140 of CIF 1800 1999cc Vehicle Engine Cylinder Capacity. MFN Most Favoured Nation rate ATIGA ASEAN Trade in Goods Agreement.

These rates can be quite high and excise duties can be up to 100 percent when importing a foreign vehicle. Consequently the vast majority of cars in Malaysia are locally produced ones. If the full value of your items is over 500 MYR the import tax on a shipment will be 10.

The ad valorem rates of import duties range from 2 to 60Raw materials machinery essential foodstuffs and pharmaceutical products are generally non-dutiable or subject to duties at lower rates. Estimate your tax and duties when shipping from United States to Malaysia based on your shipment weight value and product type. In this McLaren case you can save estimated RM 360000 After 2 years Your import car tax will be reduced by 30 1st year 15 total 45.

Sales tax - 10 of CIF Import Duty IMPORT DUTY FOR PASSENGER CARS PETROL ENGINE Upto 1799 cc.

Importing Cars In Malaysia Expatgo

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

![]()

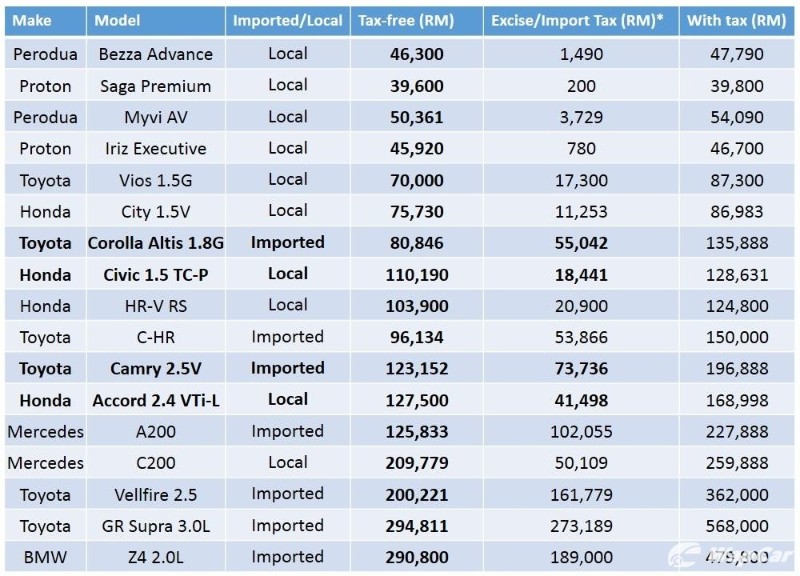

Here S What 2019 Imported Cars Cost Before Taxes In Malaysia

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

0 Response to "Malaysia Car Import Tax"

Post a Comment